Motivation

Why Do So Many Americans Actually Like Paying Taxes?

Research from psychology, economics, and political science provides answers.

Posted April 19, 2016

It’s a recurring refrain during tax season each year. A slew of surveys commissioned by various companies and universities reveal their findings. Each one devises ever more creative ways to show just how much Americans hate paying taxes. In 2016, for example, a survey of 1,000 taxpayers conducted by WalletHub found that 27% of respondents would rather brand themselves with a tattoo that says “IRS”, and 11% would gladly drive to Chipotle every single day for three years to clean its toilets if they never had to pay income taxes again. This sounds like pretty extreme aversion to paying taxes.

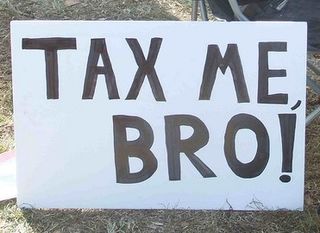

I have always been puzzled by such reports because they don’t reflect my own feelings about paying taxes at all. As an immigrant to the United States in the early 1990s, I have always seen the act of paying income taxes as a way of making a concrete contribution in dollars and cents, as a way of giving back to my chosen home country with gratitude. Compared to other countries I have lived in, I see tax dollars put to good use here in America. Simply put, I quite like paying taxes.

It turns out I am not alone. Although popular surveys focus on the tax-haters, the truth is that many Americans actually like paying taxes.

And there is interesting research to back this up.

What is the evidence?

Given the relatively low risk of getting audited if you cheat on your taxes (less than 1% in 2014, if you did not own a business), far more people pay taxes than economic models of decision making would predict. (Behavioral economists call this phenomenon the “puzzle of tax compliance”). What is more, experimental research shows that people report far higher incomes than they logically should if they wanted to act on their purported hatred of tax-paying. After all, lying and reporting lower incomes would mean they would have to pay less tax.

Consistently, in surveys, close to 80% of Americans indicate that it is morally wrong to cheat on taxes, and 96% agree that “it is every American’s civic duty to pay their fair share of taxes.”

A 2006 study by economists James Alm and Benno Torgler found that when compared to citizens of 14 European nations, Americans had the highest intrinsic motivation to pay taxes (they called this motivation “tax morale”). All these results indicate there is a significant gap between what we see in the media about how Americans hate taxes and the actual beliefs and behaviors of Americans about paying taxes which is quite positive.

How can we explain these surprising and counter-intuitive findings?

Paying taxes is prosocial behavior and is propelled by three motivations

At its heart, paying income taxes is prosocial behavior – acting to help others with no clear tangible benefit to oneself, and many people enjoy doing it. Economists Iwan Djanali and Damien Sheehan-Connor call this idea the “tax affinity hypothesis.” In some ways (but not all), the psychological consequences of paying taxes are similar to those of giving money to a charitable cause. The supported “cause” in the case of taxes is the continued functioning of the government and the advancement of its projects that serve the common good.

Social psychological and behavioral economics research indicates there are at least three motivations for prosocial giving that explain why people like paying taxes.

1) Warm Glow

For many people, the act of giving, whether it is cold, hard cash, one’s time, or expertise, or something else, is motivated by more than altruism. It is fueled by feeling a “warm glow”. What is a warm glow exactly? It is a sense of satisfaction from having done something good. For those who like paying taxes, the desire to experience a warm glow is a significant motivator, and encourages future tax compliance. This motivation is illustrated nicely in the research of political scientist Vanessa Williamson (who studies people’s attitudes towards taxation). In one of her studies, she reports an interviewee as saying, “It feels good to be able to contribute and to know that you’re part of the reason why there’s an infrastructure in place.” Classic warm glow reasoning!

2) Reciprocity

Many people feel a sense of responsibility to give back to their country and fellow citizens in exchange for the benefits they have gotten. They see paying taxes as one way to reciprocate. (I fall into this camp myself). Such a motivation will also manifest through expressions of patriotism or civic duty. But reciprocity is a double-edged sword. One study conducted in Armenia, for instance, found that most Armenians evaded taxes primarily because they felt they did not owe anything to the government because it did nothing for them. At present, attitudes of Americans towards elected government officials are at really low levels. If they transfer to the government machinery as a whole, and Americans start thinking that the government is ineffective in dealing with important issues like education, environment, terrorism, etc., reciprocity will hurt rather than help tax compliance.

3) Positive Self-signalling

A third reason that individuals behave prosocially is to provide a “self-signal” to themselves about good qualities. In describing their theory of self-signals, psychologists Ronit Bodner and Drazen Prelec say: “Actions provide a signal to ourselves, that is, actions are self-signaling. For example, a person who takes the daily jog in spite of the rain may see that as a gratifying signal of willpower, dedication, or future well-being. For someone uncertain about where he or she stands with respect to these dispositions, each new choice can provide a bit of good or bad "news.”” This theory explains why many people embrace tax-paying. When people pay taxes enthusiastically, in effect they are delivering a strong self-signal, indicating their commitment to their country and conveying a host of positive characteristics to themselves. Simply speaking, paying taxes makes people feel good about themselves, and increases their self-esteem.

There are also other reasons which can explain why people enjoy paying taxes. For example, strange as it sounds, for some people, paying taxes is a status-symbol; a way of keeping score and one-upping one’s peer group (“I paid more tax than you”). In India, for example, the government actually confers status by publicly felicitating prominent citizens such as tycoons and movie-stars for being the highest tax-payers in a particular city or state.

Despite this discussion about Americans who love to pay taxes, I do not mean to imply this is the majority stance. Or even that anyone actually enjoys the process of preparing and filing tax returns. There is a flip side to the coin. There are many concrete reasons that people hate to pay taxes that are just as strong. And regardless of their attitude towards taxation, few people like the process of tax preparation and filing. They find it too complicated. But at the end of this tax season, let's be thankful we live in a country that collects taxes and does at least some good things with the money.

I teach marketing and pricing to MBA students at Rice University. My forthcoming book is How to Make Good Pricing Decisions: A Guide for Managers and Entrepreneurs.You can find more information about me on my website or follow me on LinkedIn, Facebook, or Twitter @ud.